life insurance

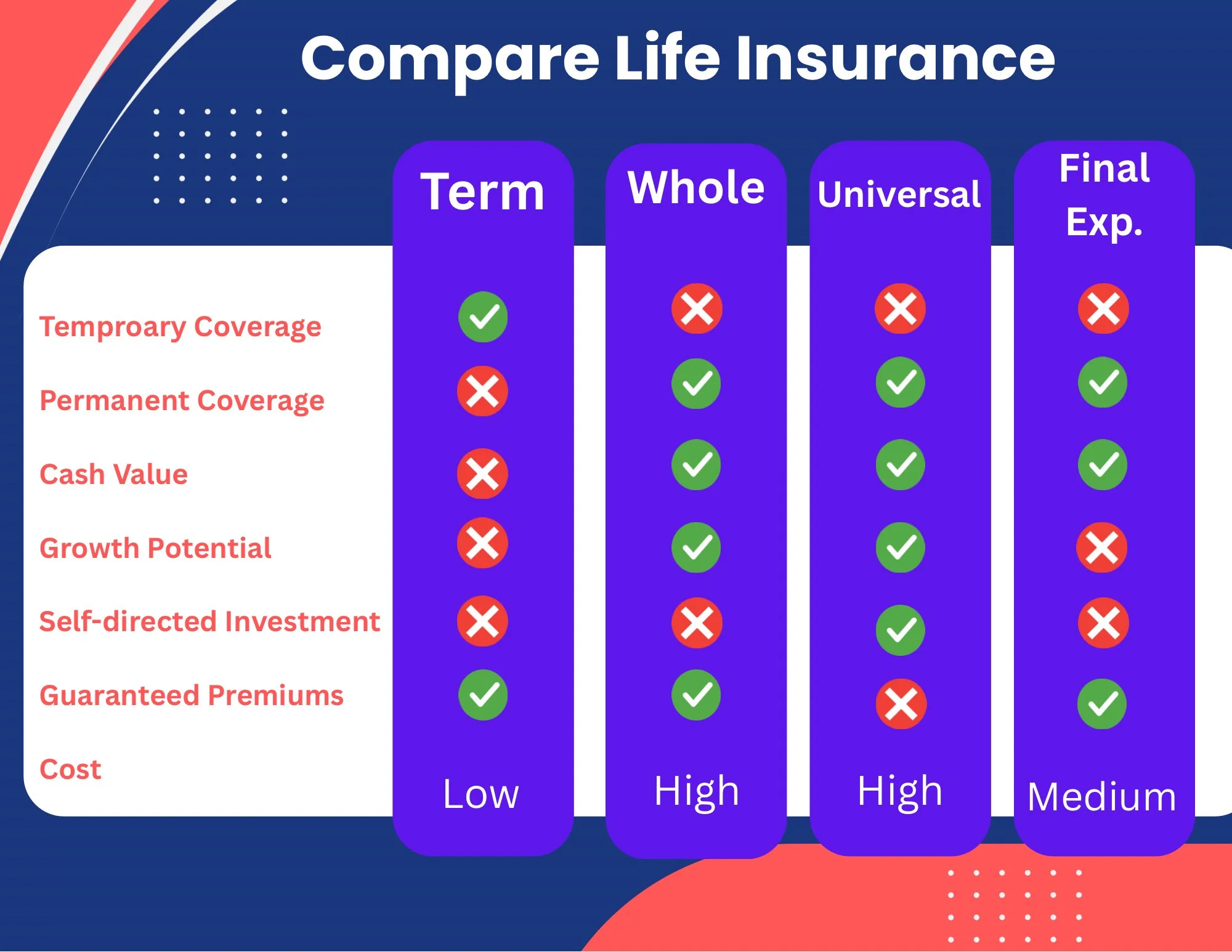

Life insurance is one of the most important steps you can take to help protect your family’s financial future. In the event of a loss, life insurance benefits can help recover everyday expenses, support long-term goals such as education or retirement, and provide financial security during a difficult time. If you’re considering life insurance, we’re here to review your situation and share options that give you and your loved ones greater peace of mind.

-

Term insurance

Term life insurance is often the most affordable type of coverage when first purchased and is designed to meet temporary needs. It provides protection for a specific period of time (the “term”) and generally pays a benefit only if the insured passes away during that period.

This type of coverage can be a good fit when you need insurance for a set timeframe — for example, until your children graduate from college or a particular debt, such as a mortgage, is paid off.

-

Whole life

Whole life insurance provides lifelong protection with level premiums and a guaranteed death benefit. In addition to the insurance coverage, it also builds cash value over time. This cash value grows on a tax-deferred basis and can be borrowed against or withdrawn, giving you added flexibility.

As the most traditional form of permanent life insurance, whole life can provide both long-term financial protection and a way to accumulate value for future needs.

-

universal life

Universal life insurance is a permanent type of coverage that offers more flexibility than whole life insurance. It provides lifelong protection while also building cash value, but unlike whole life, it allows you to adjust your premiums and death benefit as your needs change.

The cash value grows tax-deferred at a rate set by the insurance company, and you may be able to use it to help pay premiums or access funds if needed. This flexibility makes universal life a good option for people who want long-term coverage with adjustable features.

-

final expense

Final expense insurance is designed to help cover end-of-life costs such as funeral expenses, medical bills, or small outstanding debts. This type of policy provides a smaller, affordable amount of coverage that pays a cash benefit directly to your chosen beneficiary.

By easing the financial stress of final arrangements, final expense insurance helps ensure your loved ones can focus on what matters most — remembering and honoring your life.